Day trading has the potential to make a lot of money and this is the reason, hundreds of thousands of individuals engage in day trading. However, it’s not as easy as some people make it out to be. It is inherently dangerous, especially for newbies who jump into it without any kind of training or planning. It is important to take it seriously and not treat it as a hobby if you want to make serious money. If you are interested in becoming a day trader, here are a few tips on how to do it successfully.

Day trading has the potential to make a lot of money and this is the reason, hundreds of thousands of individuals engage in day trading. However, it’s not as easy as some people make it out to be. It is inherently dangerous, especially for newbies who jump into it without any kind of training or planning. It is important to take it seriously and not treat it as a hobby if you want to make serious money. If you are interested in becoming a day trader, here are a few tips on how to do it successfully.

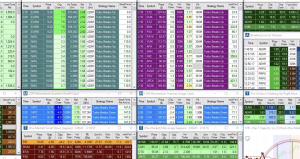

Apart from basic trading strategies, the most important thing traders need to focus on is knowledge. When it comes to day trading, the thing that matters the most for traders is the latest news as prices of financial instruments keep changing with news of events that affect the prices of various instruments. For instance, the latest report outlining the economic outlook or the interest rate plans and other such things have a huge impact on the short-term prices of financial instruments and traders need to be aware of this information to make money or to avoid losses. Therefore, you would need to come up with a strategy to keep yourself aware of the latest news through various means including financial websites (tradeideaspromocode.net), business news channels, and other such things.

You need money to make money in this industry. However, you also need to have a strategy wherein you don’t risk all your money on a single trade. Most successful traders risk only a certain percentage of their trading account on a single trade. Fix a particular amount you are willing to risk on each trade and more importantly, you should always stick to that limit.

As mentioned in the beginning, it’s not a hobby and you are unlikely to make any money if you treat it as a hobby. Treat it as a job which means you will need to spend some time to learn the basics of trading and to learn how to make money in any kind of market. The good thing about this industry is that you can begin to learn even while holding on to other jobs. Jump into it full time only when you are comfortable trading daily.

One of the biggest mistakes made by failed traders is that they start big hoping to make a large amount of money in a few days. Experts recommend starting small. Ideally, you should focus on one or two financial instruments during a particular session. It will allow you to find opportunities easily as you will have to focus on a few instruments instead of keeping track of a large number of stocks or other instruments.

One of the most common mistakes made by traders in this industry is that they are lured by the potential gains to be made in trading of penny stocks. Some traders have made a ton of money dealing in penny stocks but not everyone has been successful. Keep in mind that these are illiquid stocks and there is a one in a million chance that you’ll hit the jackpot when trading in penny stocks.

While day trading has the potential to make a lot of money, it does not mean that you are going to become a millionaire overnight. You need to be realistic about profits. You’re not going to win all the time. Therefore, don’t lose heart if you end up making a loss on a particular day.

Most of the successful traders only win 50-60% of their trades. The key is that their wins are much bigger as compared to their losses. Therefore, you need to focus on each trade and that is only possible if you have a specific strategy and you stick to that strategy.

One of the most important things you need to learn as a successful trader is to keep your cool when the market is testing you. You need to learn how to stay away from hope, greed, and fear. Emotional decisions are never going to make money. Learn to be logical and not emotional when you are trading.

Overall, these are some of the important things you need to keep in mind to become a successful day trader. Devise a strategy and stick to that strategy if you want to be successful in the long term.